Bitcoin traded in a tight range on Friday, holding above the $90,000 level as investors across global markets paused ahead of fresh guidance from the Federal Reserve.

BTC hovered between $89,500 and $91,200 through the U.S. session, according to market data, with volumes thinning on major exchanges as traders avoided taking directional bets. The muted price action mirrored broader risk markets, where equities and bonds also struggled to establish momentum.

Market participants said Bitcoin’s ability to defend the $90,000 zone reflects a change in market structure compared with previous cycles. Rather than sharp selloffs during periods of macro uncertainty, large holders appear willing to hold positions while awaiting clearer policy signals.

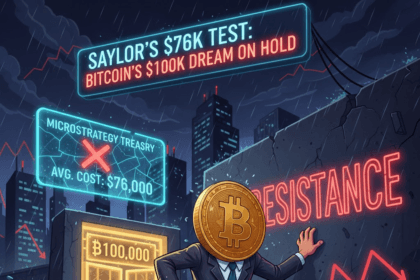

On-chain data and exchange flow metrics showed limited distribution from long-term holders, helping cap downside pressure. At the same time, upside momentum remained constrained, with resistance seen near the $92,000 area, where sellers have repeatedly emerged in recent sessions.

Bitcoin’s stability comes as traders broadly expect the Federal Reserve to keep interest rates unchanged at its upcoming meeting, following mixed U.S. economic data. Yields on the 10-year Treasury held near 4.2%, while the U.S. dollar index remained largely flat, offering little directional impulse for crypto markets.

With macro assets moving sideways, traders said a decisive move in Bitcoin is more likely to follow confirmation from central bank messaging rather than technical signals alone. Until then, price action is expected to remain rangebound.