As ETF money retreats and exchange inflows surge, a powerful layer of the market is quietly repositioning ahead of what could be crypto’s next major test.

The largest private holders in Bitcoin are no longer sitting still.

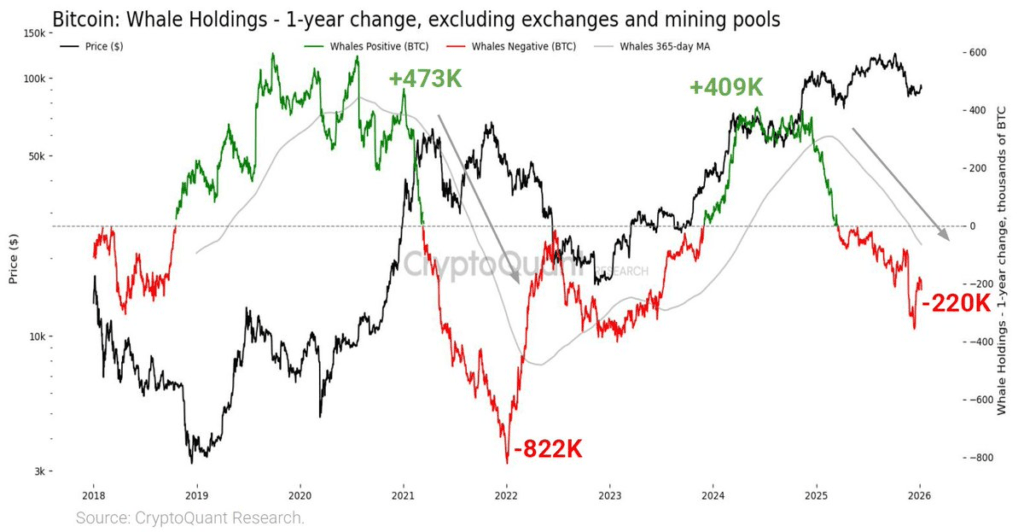

On-chain data shows wallets holding between 1,000 and 10,000 BTC have shed more than 220,000 bitcoin since their March 2024 peak, marking the fastest distribution phase since the last major drawdown in 2023. Those balances have fallen from roughly 409,000 BTC to near 220,000 BTC, a shift that is rippling through both spot markets and institutional order books.

The timing is not random. Bitcoin’s repeated failures to hold above the $95,000 zone, combined with heavy selling pressure inside spot Bitcoin ETFs, has triggered a structural change in how large capital is engaging with the asset. While price has stabilized near $90,600, the deeper flow data tells a far more cautious story.

Last week alone, U.S. spot Bitcoin ETFs saw $681 million in net redemptions, according to SosoValue. The heaviest hit came on January 7, when nearly half a billion dollars exited in a single session. December ended with more than $1 billion in net ETF outflows, and 2026 has so far opened with nearly $210 million in redemptions.

As institutional demand weakens, whales appear to be stepping away from risk.

Where the supply is quietly leaking

Blockchain analytics firm Glassnode shows that large-holder balances began falling almost immediately after Bitcoin’s March 2024 highs. That selloff has continued in waves, with each failed rally triggering another round of distribution.

CryptoQuant’s head of research, Julio Moreno, has warned that much of what appears to be whale accumulation is distorted by exchange wallet movements. When exchange addresses are removed from the dataset, real whale balances have been falling for months.

The implication is stark: the most informed long-term holders are not accumulating into strength. They are reducing exposure into it.

This matters because the 1,000–10,000 BTC cohort sits in a critical middle layer of the market. They are large enough to move price but not so large that they are structurally locked into custody solutions. Their behavior often precedes broader market turns.

Binance is absorbing the pressure

The destination for much of this bitcoin is not private cold storage. It is exchanges.

CryptoQuant data shows the BTC exchange whale ratio has climbed to 0.504, the highest in ten months, a level historically associated with rising sell-side pressure. Binance has become the primary receiver of those flows, now accounting for roughly 71% of all stablecoin deposits across exchanges and a growing share of BTC inflows.

In January, Binance recorded an average bitcoin inflow of 22.81 per block, the highest reading in two years. Similar patterns preceded the 2025 selloff and the October liquidation cascade, when whales moved assets onto exchanges just before sharp price declines.

The pattern suggests that some large holders are not merely de-risking. They are preparing liquidity for active selling.

The tug-of-war between old whales and new money

Not all big money is leaving.

On January 7, three newly active wallets acquired roughly $280 million worth of bitcoin in a single session. Santiment data shows that Bitcoin’s break back above $90,000 reactivated several large buyers who had been dormant during the December drawdown.

Coin Bureau reports that nearly 50% of Bitcoin’s realized capitalization now belongs to new whales who entered at significantly higher prices. These participants, often institutions and high-net-worth allocators, have been absorbing supply without waiting for deep corrections.

This is creating a structural standoff inside the market. Older whales who accumulated at much lower levels are distributing into strength, while newer capital is stepping in above $80,000.

The result is a fragile equilibrium that depends heavily on whether ETF flows stabilize or continue to drain.

Why this cycle feels different

In previous bull markets, whale distribution tended to be absorbed by retail speculation. In 2026, the marginal buyer is no longer retail—it is ETFs, funds, and balance sheets.

When those channels are pulling capital out, as they are now, even moderate whale selling can tilt the market. That dynamic is why Bitcoin has struggled to regain the $95,000 level despite repeated attempts.

With BTC trading near $90,667, the market is not in panic. But the architecture beneath the price is shifting.

Large holders are no longer betting on straight-line upside. They are managing risk.

And history suggests that when whales do that in unison, the rest of the market usually follows.