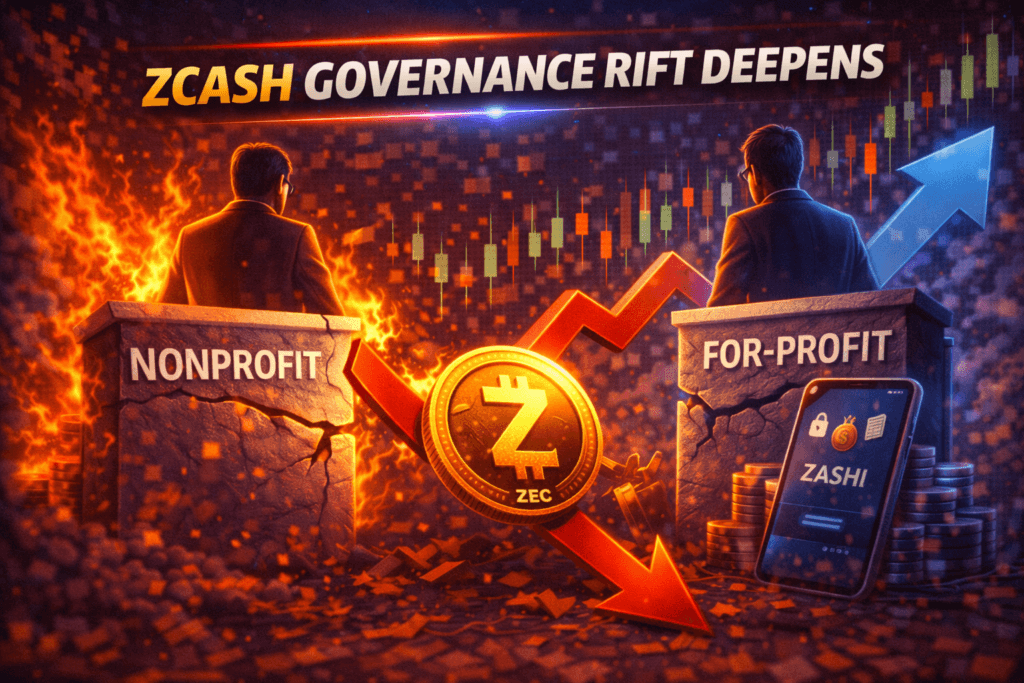

Bootstrap, the nonprofit supporting Zcash, said a governance dispute that triggered a high-profile split stems from legal constraints tied to U.S. nonprofit rules, as questions swirl around the future of the Zashi wallet and ZEC slides.

The response follows the Electric Coin Company’s decision to separate from Bootstrap and form a new for-profit entity. ECC leaders cited what they described as hostile governance actions, while Bootstrap says the disagreement centered on how far a nonprofit can go when seeking outside investment.

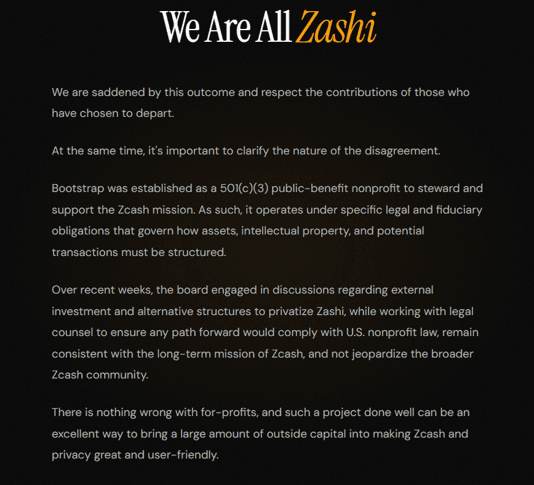

Bootstrap explained that board discussions focused on potential external investment and alternative structures to privatize Zashi, a self-custodial wallet built for private Zcash transactions. According to the nonprofit, these talks were conducted with legal counsel to ensure compliance with U.S. nonprofit law and to protect the broader Zcash ecosystem.

Zashi was developed by ECC and launched in early 2024. Its code is open source, consistent with Zcash’s permissionless design, and no single entity owns or controls the protocol.

In its statement, Bootstrap stressed that as a 501(c)(3) nonprofit, it has fiduciary obligations that limit how assets can be transferred or monetized. The board warned that certain privatization paths could expose Zcash to donor lawsuits or politically motivated scrutiny, potentially forcing transactions to be unwound.

Bootstrap said such risks could jeopardize the entire ecosystem and emphasized that any restructuring must serve the public good rather than private benefit. The nonprofit rejected claims that the dispute reflects opposition to Zcash’s mission or to for-profit development more broadly.

At the same time, Bootstrap acknowledged the limits of the nonprofit model. Board members said for-profit entities can attract significantly more external capital and, if structured properly, could accelerate privacy innovation and adoption within the Zcash ecosystem.

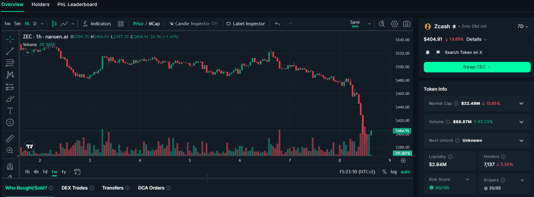

Market reaction was mixed. ZEC fell roughly 16% over the past 24 hours to trade near $406. Despite the drop, on-chain data showed large holders increasing exposure, with whales and newly created wallets accumulating millions of dollars’ worth of ZEC during the selloff.

The split highlights a broader tension facing privacy-focused crypto projects: balancing open-source principles and nonprofit governance with the need for capital, growth, and user-friendly products.