Bitcoin slid toward its lowest level since Donald Trump returned to the White House, pressured by fragile investor sentiment and escalating global market turbulence.

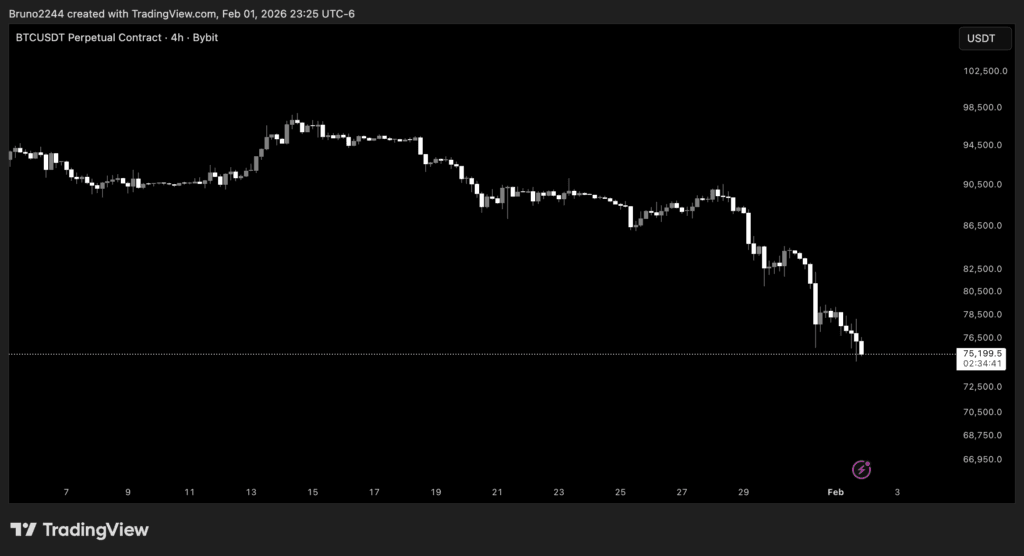

The largest cryptocurrency fell as much as 2.5% to $74,541 during Asia trading on Monday, hovering just above the $74,425 low recorded on April 7. Prices remained below $76,000 by midday in Singapore as risk appetite weakened across assets.

Bitcoin has now dropped nearly 11% in January, marking its fourth consecutive monthly decline. This is its longest losing streak since 2018, when the market unraveled after the 2017 initial coin offering boom.

The latest downturn comes amid broader financial unrest. Gold extended losses on Monday after suffering its steepest plunge in more than a decade late last week, highlighting a widespread retreat from risk.

“Bitcoin is approaching levels last seen in April 2025 after Liberation Day,” said Caroline Mauron, co-founder of Orbit Markets. She warned that a decisive break below the 2021 highs near $70,000 would significantly damage long-term confidence.

Losses were not limited to Bitcoin. Ether declined 2.9%, while Solana fell 1.2%, reflecting broad weakness across major digital assets.

With macro uncertainty rising and technical levels under pressure, traders are watching closely to see whether Bitcoin can stabilize or faces deeper downside in the days ahead.