Mexico is quietly reconsidering a policy that keeps Cuba’s lights on. Senior officials say President Claudia Sheinbaum’s government is reviewing whether to scale back or halt oil shipments to Cuba, amid mounting concern that Washington—under Donald Trump—could retaliate.

The review comes as Venezuelan supplies to Havana have collapsed following U.S. action, leaving Mexico—via state oil firm Pemex—as Cuba’s single largest remaining supplier. With energy shortages and rolling blackouts already battering the island, any change from Mexico would hit hard.

Publicly, Mexico insists shipments are legal, contractual, and humanitarian. Privately, officials acknowledge rising anxiety as Trump declares there will be “no more oil or money going to Cuba,” while pressing Mexico on trade talks, cartel enforcement, and sovereignty. Options under discussion range from maintaining flows, to reducing volumes, to a full stop—none decided.

Complicating matters, U.S. surveillance activity has intensified. Mexican officials are increasingly wary of U.S. Navy reconnaissance drones flying over the Gulf of Mexico along routes used by tankers bound for Cuba—mirroring patterns seen near Venezuela ahead of past U.S. actions.

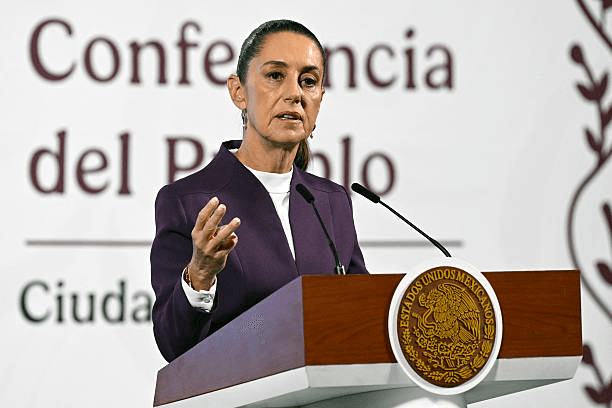

Sheinbaum has pushed back, calling unilateral U.S. military moves on Mexican soil a red line, even as her government accelerates cartel crackdowns and extraditions praised in Washington. But the stakes are broader: officials fear cutting Cuba’s fuel could trigger a humanitarian spiral and drive mass migration north, spilling into Mexico.

The numbers underscore the leverage. Last year, Mexico shipped roughly 17,200 barrels per day of crude and 2,000 bpd of refined products to Cuba—about $400 million worth—at a moment when few producers are willing to step in under U.S. scrutiny.

For now, Mexico is balancing solidarity with Cuba against the risk of provoking Washington. The decision—reduce, pause, or proceed—could reshape regional energy flows overnight.