US President Donald Trump’s nomination of former Federal Reserve governor Kevin Warsh as Fed chair is creating a mixed macro outlook for Bitcoin, with analysts warning that liquidity may stabilize rather than expand.

Trump nominated Warsh on Friday to replace Jerome Powell when his term ends in May, pending Senate approval. While Warsh is viewed as Bitcoin-friendly and open to rate cuts, analysts say his stance on balance sheet policy could limit upside for risk assets.

According to Thomas Perfumo, global economist at Kraken, the nomination suggests liquidity conditions are unlikely to meaningfully improve. Bitcoin and crypto markets remain highly sensitive to liquidity trends, often more than headline changes to the Fed funds rate.

Warsh has previously expressed skepticism toward further balance sheet expansion, including quantitative easing. Analysts say this could disappoint investors expecting aggressive monetary support during periods of market stress.

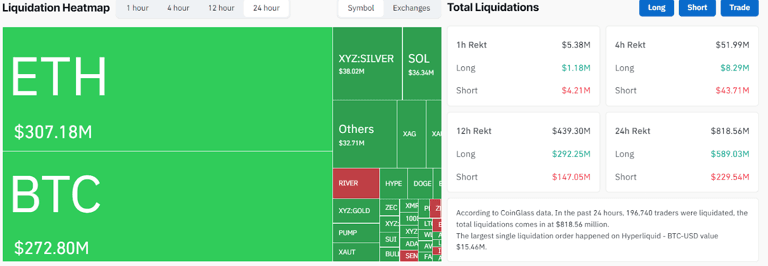

The nomination comes after crypto markets shed roughly $250 billion in market capitalization over the weekend amid a broader sell-off in equities and precious metals. Analysts including Raoul Pal have attributed the downturn to tightening US liquidity rather than crypto-specific factors.

Nic Puckrin, co-founder of Coin Bureau, said Warsh’s views on shrinking the Fed’s balance sheet are a key driver of recent volatility. He warned that a lower-liquidity environment would weigh on both risk assets and precious metals if implemented.

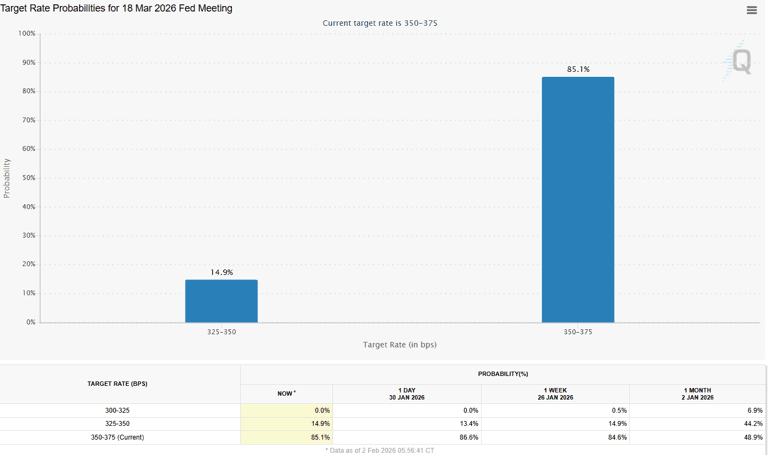

Despite the concerns, interest rate expectations remain stable. CME FedWatch data shows 85% of traders expect rates to remain unchanged at the March 18 meeting. For June, markets see a 49% probability of a 25-basis-point cut, which would be the first meeting after Powell’s term ends.

For Bitcoin, analysts say the outlook remains balanced: potential rate cuts could support prices, but limited liquidity expansion may cap upside in the near term.