Digital wallets are rapidly reshaping how people store, move, and protect money as mobile payments replace traditional cash and cards.

Apps like Apple Wallet and Google Wallet now allow users to pay, store cards, tickets, and IDs securely on their smartphones, offering both convenience and improved financial control.

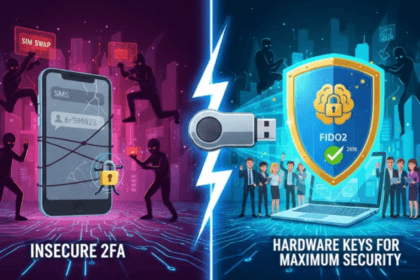

At the core of digital wallets is tokenization and encryption, which prevent real card numbers from being shared during transactions, significantly reducing fraud risk compared to physical cards.

Security is a major advantage. Even if a phone is lost or stolen, biometric authentication and device-level encryption make unauthorized access extremely difficult.

Digital wallets also simplify rewards optimization. Users can store multiple credit cards and select the best option for cashback, travel points, or category-specific rewards at checkout.

Beyond payments, wallets now support boarding passes, event tickets, loyalty cards, and gift cards, consolidating everyday essentials into one secure interface.

However, digital wallets aren’t flawless. They require battery power, smartphone access, and merchant compatibility, which isn’t yet universal.

Financial experts recommend using digital wallets alongside physical cards, not as a full replacement, while adoption continues to expand globally.

As contactless payments become standard, digital wallets are emerging as a foundational tool for modern financial management.