The record-breaking run for XRP exchange-traded funds has finally met its match. After 54 days of uninterrupted capital accumulation, the U.S. spot XRP ETF market recorded its first day of net outflows on January 7, 2026, as investors began locking in gains following a massive early-year rally.

The End of the 54-Day Streak

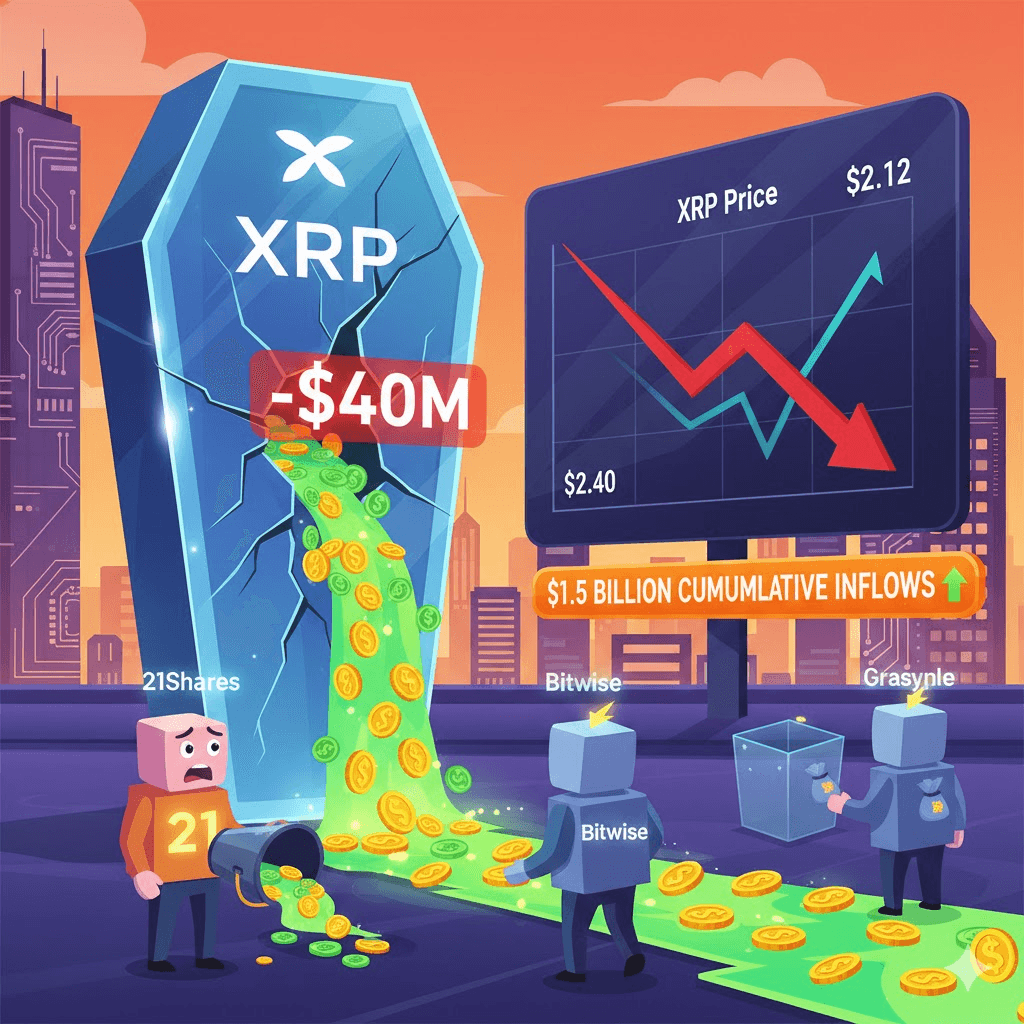

Data from SoSoValue confirms that the “honeymoon phase” for XRP ETFs saw a brief pause this week. Roughly $40.8 million was withdrawn from the ecosystem on Wednesday, marking the first daily reversal since the initial wave of spot products launched in mid-November 2025.

The heavy lifting for the outflows was concentrated in a single fund:

- 21Shares (TOXR): Accounted for the lion’s share of redemptions with $47.25 million exiting the fund.

- Cushioning the Blow: The net figure was slightly offset by continued, albeit modest, inflows into Bitwise and Grayscale products.

- Stable Holdings: Franklin Templeton’s XRP fund (XRPZ) reported zero net activity, suggesting institutional holders in that vehicle are maintaining a “wait-and-see” approach.

Price Correction Triggers the Exit

The shift in sentiment followed a sharp rejection at the $2.40 psychological resistance level. After surging 25% in the first week of 2026—briefly earning the title of “the new crypto darling” on CNBC—XRP’s price tumbled more than 12% from its Monday high.

At the time of reporting, XRP is trading near $2.12. Analysts describe this as a “healthy reset” after an overextended move. Despite the $40 million exit, cumulative inflows since November still stand at a robust $1.5 billion, indicating that the long-term institutional thesis for XRP remains intact.

Broader Market Pressure

XRP was not alone in its retreat. The outflows coincided with a brutal day for the broader crypto ETF sector:

- Bitcoin ETFs: Shed a massive $486 million in a single session.

- Ethereum ETFs: Recorded $98 million in net outflows.

The divergence in flow data across asset classes suggests that early-year portfolio rebalancing and macro-economic caution are currently outweighing the specific asset narratives.